us germany tax treaty summary

For more details on the whether a tax treaty between the United States. Summary of US tax treaty benefits Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income.

German Tax Advice For Smart Foreign Real Estate Investors Owners

The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty.

. Germany and the United States signed an income and capital tax convention and an accompanying protocol on August 29 1989. Standard VAT rate 19 A temporary deduction of the VAT rate on meals except for beverages provided in restaurants and through other catering. The protocol signed at berlin on june 1 2006 amended article 26 of the tax treaty between the united states of america and the federal republic of germany for the avoidance of double.

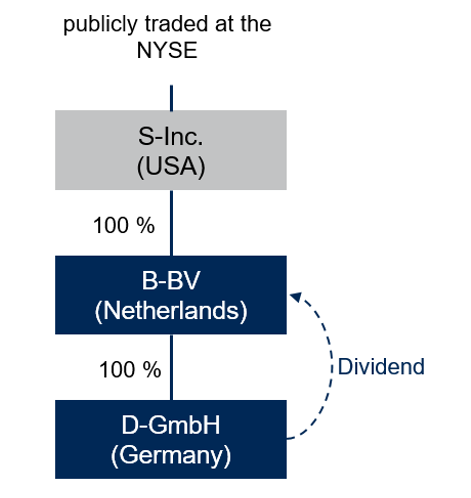

PwC World Wide Tax Summaries WWTS helps external client users to get up-to-date summary of basic information about corporate tax and individual taxes in over 150 countries worldwide. Subsidiary or branch to its German parent would generally exempt from withholding tax dividend payments. The saving clause Art.

The Germany-US double taxation agreement establishes the manner in which business profits derived by German or US companies are taxed in the other country. A separate protocol and an accompanying joint. 1 4 DTC USA allows the USA to tax their own citizens regardless of the provisions of the DTC.

The income tax treaty dated 1 July 2010 with the United Arab Emirates UAE ceased to apply 31 December 2021. OverviewThe United States has income tax treaties with a number of foreign countries. Tax on payments of dividends or dividend equivalent amounts by a US.

The Treaty also states that American researchers teachers professors students and trainees on assignment in Germany for less than two years will continue solely paying US. These treaty tables provide a summary of many types of income that may be exempt or subject to a reduced rate of tax. Under these treaties residents not necessarily citizens of foreign countries may be eligible to be.

While the US Germany. However the exceptions to the saving clause in some treaties allow a resident of the United States to claim a tax treaty exemption on US. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with.

For purposes of the US-Germany tax treaty the municipal business tax is treated like an income tax. The tax is imposed on the profits income of the establishment. Germany currently has income tax treaties with 96 countries.

German national income tax law has been modified and superseded by various tax treaties with foreign countries to ensure that income is not taxed by more than one. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. Value-added tax VAT rates.

The radio and TV tax in Germany is 1836. This means that a US citizen who lives in Germany will.

Germany Usa Double Taxation Treaty

What Is The U S Germany Income Tax Treaty Becker International Law

Us Expat Taxes For Americans Living In Germany Bright Tax

Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax

Germany United States International Income Tax Treaty Explained

The Dawes Plan 1924 The Young Plan 1929 How To Plan German Propaganda Germany

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

Us Military In Germany To Create List Of People Targeted By Local Tax Authorities In Spite Of Sofa Status Stars And Stripes

The World S Refugee Crisis Past And Present Refugee Crisis Refugee Forced Migration

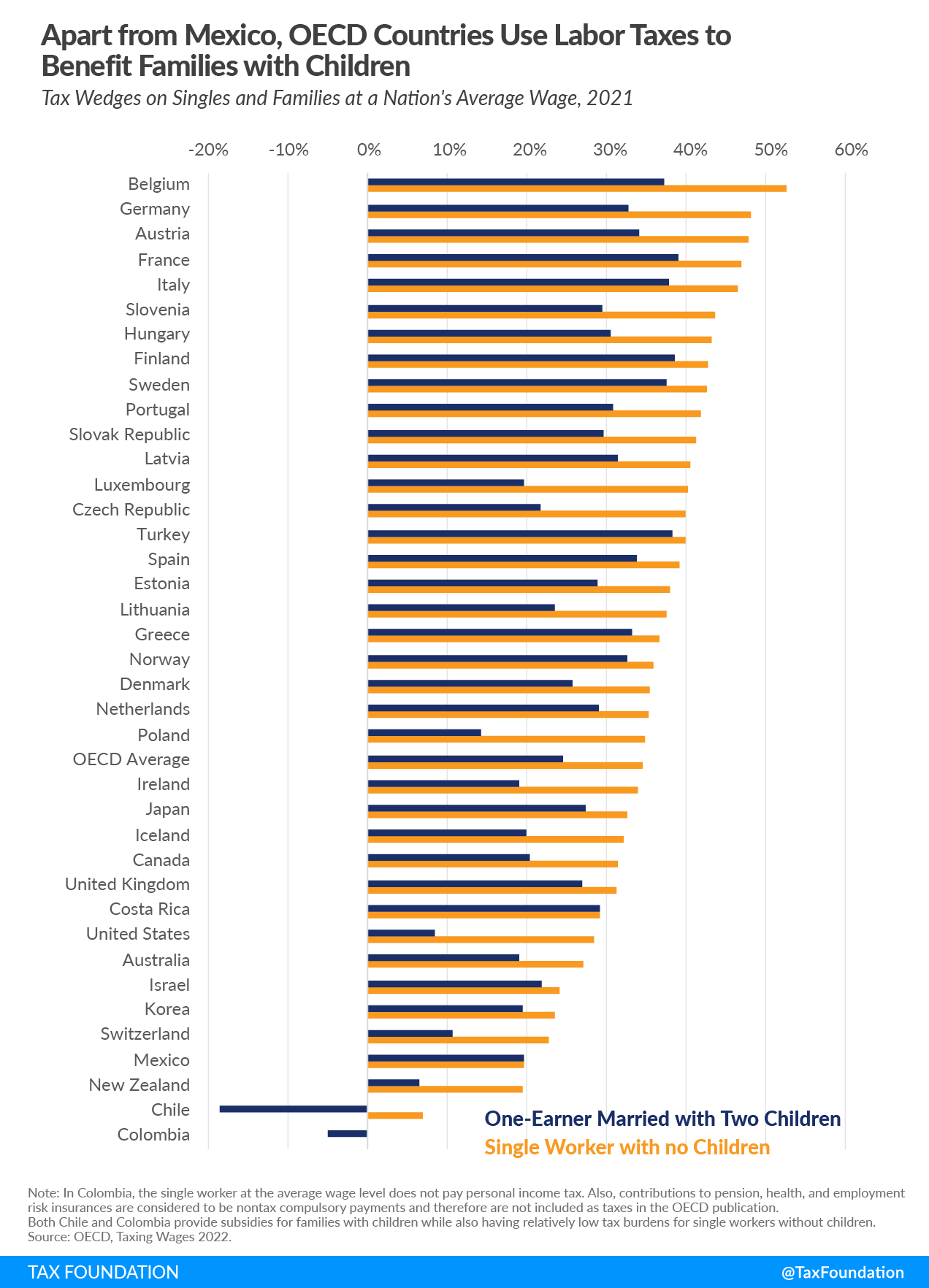

Germany Tax Information Income Taxes In Germany Tax Foundation

German Tax Advice For Smart Foreign Real Estate Investors Owners

United States Imports From Germany 2022 Data 2023 Forecast 1991 2021 Historical

United States Germany Income Tax Treaty Sf Tax Counsel

Taxes On Stocks In Germany Everything You Need To Know

Us Expat Taxes For Americans Living In Germany Bright Tax

Double Taxation Taxes On Income And Capital Federal Foreign Office